- #SMALL BUSINESS INVOICING HOW TO#

- #SMALL BUSINESS INVOICING SOFTWARE#

- #SMALL BUSINESS INVOICING PROFESSIONAL#

#SMALL BUSINESS INVOICING PROFESSIONAL#

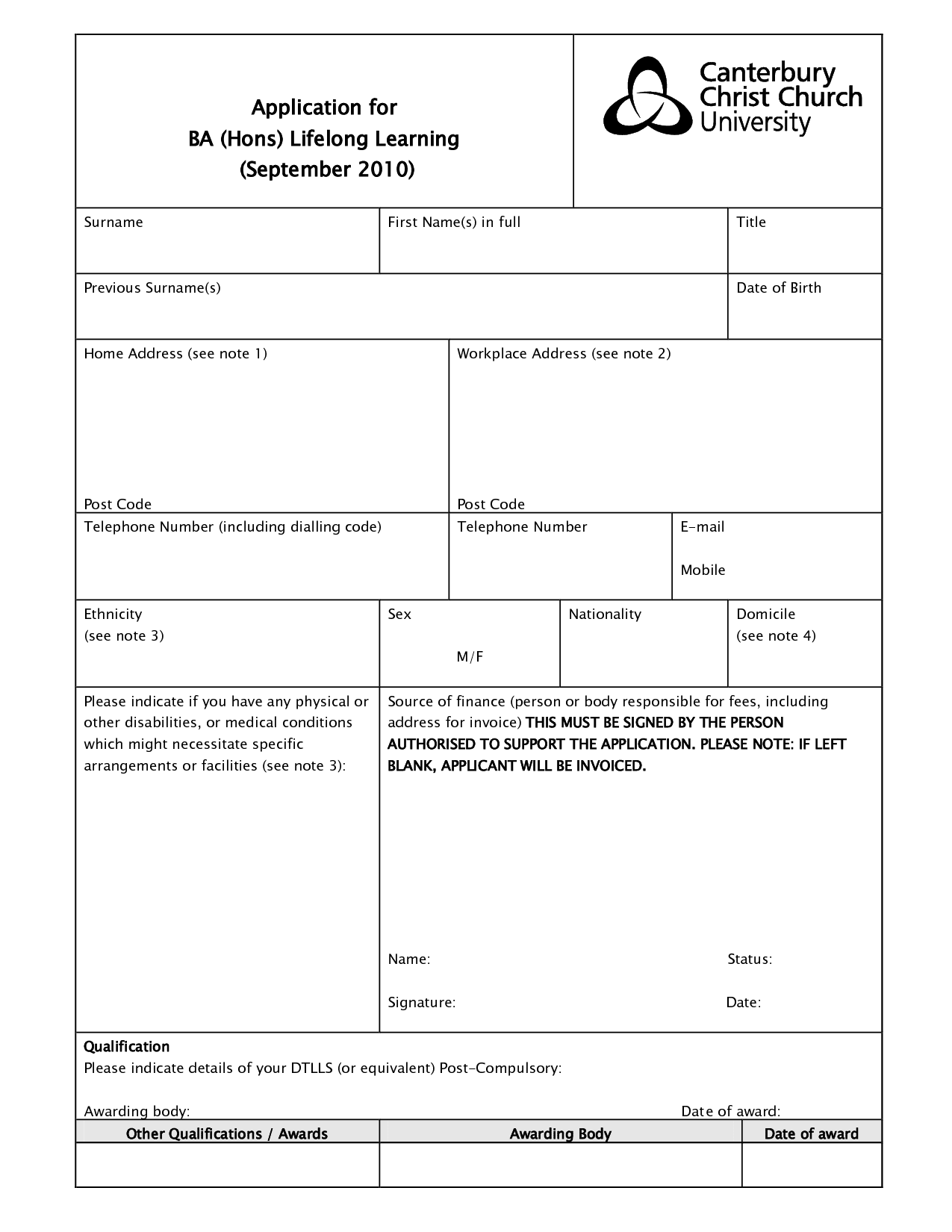

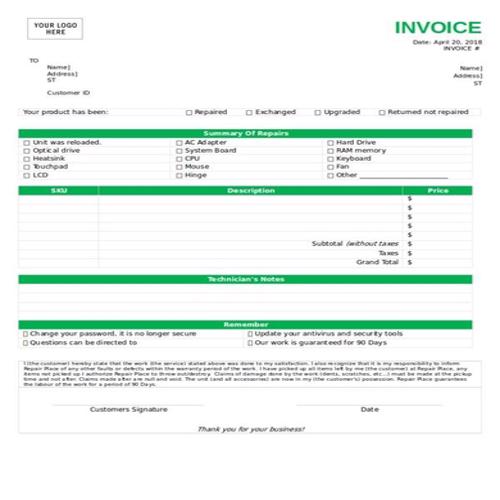

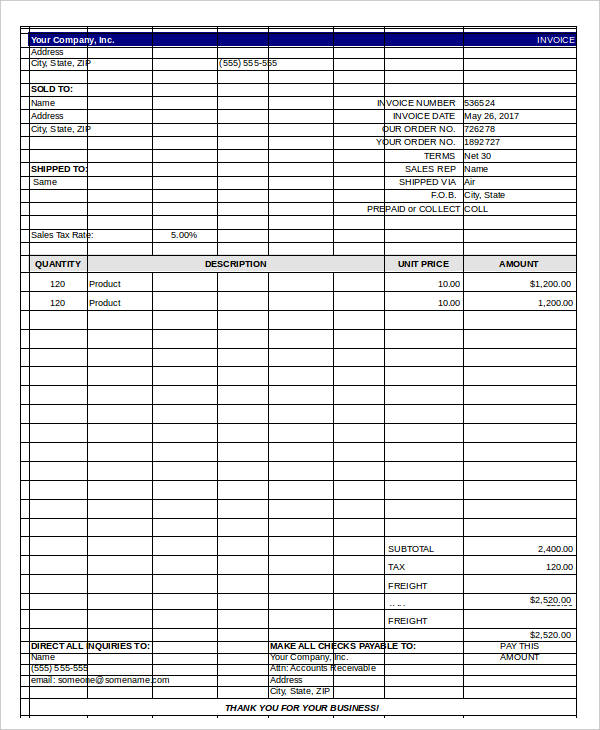

Design and present your invoice in a clear, professional manner that exudes confidence. Use your invoice as a way to brand your business: Include your company logo, colors, fonts, and any other stylistic flourishes you think will set your business apart from others. You could list all of the necessary information in a simple Word document, line by line-but would that encourage clients to take you seriously and pay promptly?

You might be familiar with this model if you use subscription services such as Netflix or Spotify.

#SMALL BUSINESS INVOICING SOFTWARE#

Invoicing is no exception.Īutomating an invoice with quality accounting software takes the human element out of the equation and makes it much more likely that your invoice will be sent in a timely, consistent manner, increasing the likelihood of its prompt payment.

Generally speaking, if you can automate a task, you should. You can also use this opportunity to set payment terms and specify a rate.Īsking a client to sign a contract isn’t awkward or a dealbreaker-and any client that refuses to do so likely isn’t someone you’ll want to do business with in the long-term. New small businesses, and sole proprietors, in particular, are often in a rush to close a deal with a new client-so much so that they’re willing to move ahead on a project before signing a contract.īut a handshake deal won’t do: A contract allows you to set the parameters of your project, ensuring that you’ll be paid regardless of whether your client has a change of heart. For new or one-off clients, make it your policy to submit an invoice immediately following the completion of work. Generally speaking, the sooner you send your invoice, the sooner you’ll get paid-and the less likely you’ll be to forget to send it altogether. But the reality is, this tactic can cause endless delays when it comes to getting paid. Perhaps you think it’s best to wait until the end of the month, or to send all of your invoices out together on a Friday afternoon. If you don’t send your invoice, you probably will never get paid.īut one common mistake that business owners make that can lead to forgetting to send an invoice is playing the waiting game. It doesn’t need to be said that forgetting to send your invoice is one blaringly obvious mistake.

#SMALL BUSINESS INVOICING HOW TO#

Here are 10 small business invoicing mistakes start-up owners make, and how to avoid them. If you’re a new small business owner, you might not recognize just how important the invoice itself is to getting paid. Seamless small business invoicing, especially for new businesses, can be the difference the between smooth business operations and having to resort to expensive loans, maxing out credit cards, and other sub-optimal financing options that make it easy for you to fall into increasing debt. And while you can’t always guarantee a client will pay early, you can avoid any invoicing mistakes that will definitely cause a late payment.

Cash flow can be held up when your customers don’t pay their invoices on time. One of the biggest issues standing in the way of success for small businesses is cash flow. Every small business owner knows just how important a timely, paid invoice is for their bottom line.

0 kommentar(er)

0 kommentar(er)